Challenger banks focus on user acquisition

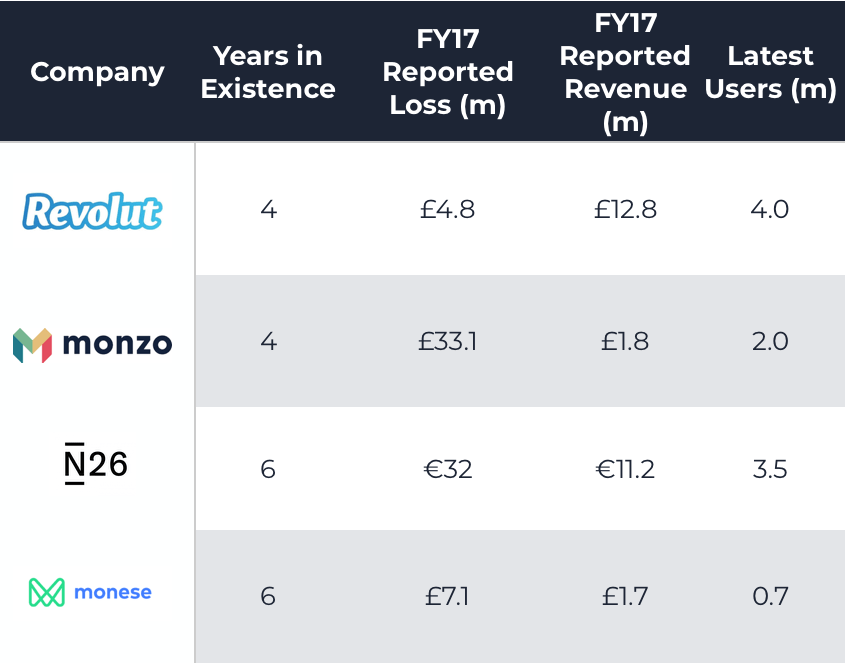

Challenger Banks have generally taken a financial hit to win customers over in a hotly contested market. Consequently, any revenues gained have been reinvested to expand. This is evident in our analysis below.

Sources: Financials – Craft.co Monese, greunderszene.de, Monzo Annual Reports, Craft.co Revolut

User data – N26 Blog, Vivainvest, Monzo Blog, Crowdfunder Insider

For example, players such as N26 and Monese seem to prioritize customer acquisition over profitability even after 6 years of operation. They still run at losses based on the last set of comparable financials across these companies.

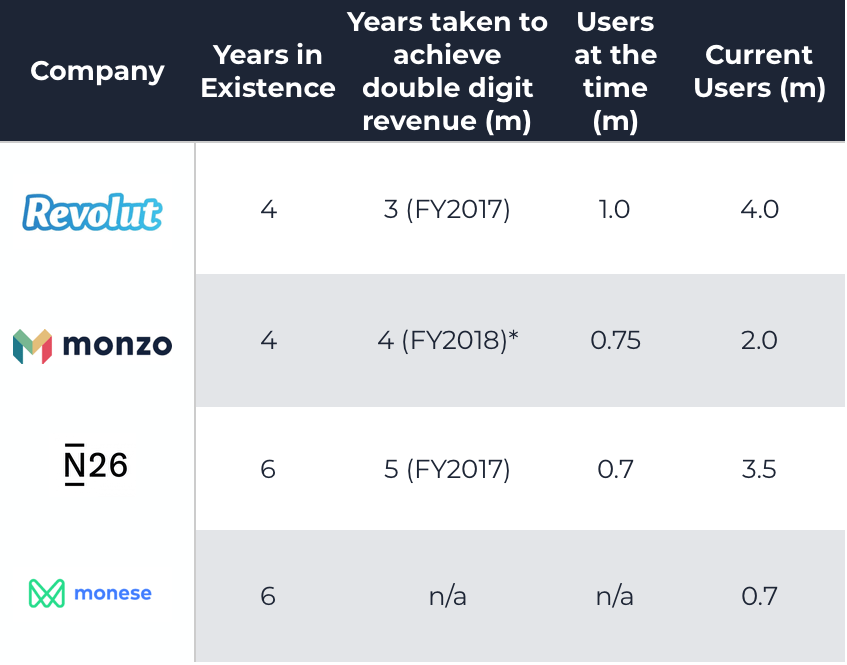

The journey to double-digit million dollar revenues

Challenger banks have had to be patient before earning the double-digit million revenues. The table below plots the journey of the banks to achieve double-digit revenues and the users it takes.

Sources: Current Users – Vivainvest, N26, Monzo, Crowdfund

Users (Historical) – BusinessInsider, Monzo Annual Report, greunderszene.de

It can be seen that it took around 3 years for these challenger banks to achieve double digit millions in revenue.* They tended to achieve this milestone at around the 800,000 user mark. The sources of these revenues have predominantly been from commissions, premium accounts, overdrafts and credit card fees.

This trend is set to continue as banks ramp up their growth efforts

Even with these negative immediate financial results, investors continue to pour money into the sector. Investors have committed over $6bn into challenger banks since 2014 and investment is set to continue. A lot of this is driven by a belief that these banks will eventually monetize their pre-existing customer bases with greater offerings such as wealth/asset management, private banking and expanded digital banking services. Also, companies such as N26 have stated that they are starting to become profitable on a per customer basis.

*Monzo has achieved a revenue close to double-digit of £9.1m.