Let’s take eBay, for example. Currently being dwarfed by competition from Amazon, the online retailing giant recently introduced an image search feature. This uses deep learning to analyze photos and find similar products for the best prices. It therefore allows users to spend less time and effort trying to find what they’re looking for with the use of a more intuitive system.

Who are driving new expectations and what’s their power?

Firstly, Millennials. The first tech-savvy generation who lived through a digital revolution that dramatically changed our day-to-day lives. They also happen to be the largest generation in Western history. So consequently, by 2030 their purchasing power will be greater than all other generations combined.

Secondly we come to Generation Z. They are the first digital natives and because of this, have a big impact on modern services and products.

Generation Z are set to soon take over Millennials as the largest cohort. Their influence on family spending is currently their greatest impact, with 93% of parents saying their children influence family and household purchases.

Businesses’ pre-existing knowledge of consumers has never been made more irrelevant so quickly.

What are young people signalling to banks?

Even these initial insights signal a call for a greater understanding of younger consumers and for (faster) innovations around financial products & services. This is crucial for traditional and established banks who want to stay relevant to customers.

Here are 10 key insights banks should know about the preferences and expectations young people have of their banks. Sourced from our report series into the Next Generation Of Banking:

10 insights banks should know:

1. 59% of young adults want tools to help them monitor their monthly budget. In addition, they want real-time adjustments based on their spending. Accenture – Beyond Digital

2. 93% of Millennials expect faster payments. They say it is at least somewhat important that payments they make are made in real-time (to compare, the average for the overall population was 76%). Fiserv, Harris Poll 2016

3. Only 5% of Millennials feel their bank understands them financially. Forrester Research

4. 48% of Millennials are interested in real-time and forward-looking spending analysis. Forrester Research

5. For every 10 Millennials who switch banks, 8 give the reason it is to obtain better rewards for completing specific goals. Kasasa

6. The #1 way Millennials say their bank can be a valued partner is by rewarding their loyalty (60% want their bank to be a partner/friend). Shep Hyken – customer service expert & NYTimes bestseller

7. 78% of consumers would be interested in receiving financial advice or guidance from their bank. However, only 28% said they currently receive financial advice.

Additional insight: 53% of Millennials say they have no-one to turn to for financial guidance, which is a huge opportunity for existing banks. Lendit Fintech USA

8. “Gen Zers want stability, they want partnership, they want their bank to feel like part of their squad.” – Civic Science 2017

9. 75% of Millennials are open to having a virtual meeting (video chat) with their financial advisor. Intelligent Environments – Generational Shift

10. 32% of Millennials consider an “easy to use smartphone app” a primary factor when selecting a bank. This same statistic falls to 16% for older generations.

Additional insight: 92% of young adults would choose a bank for its’ digital services.

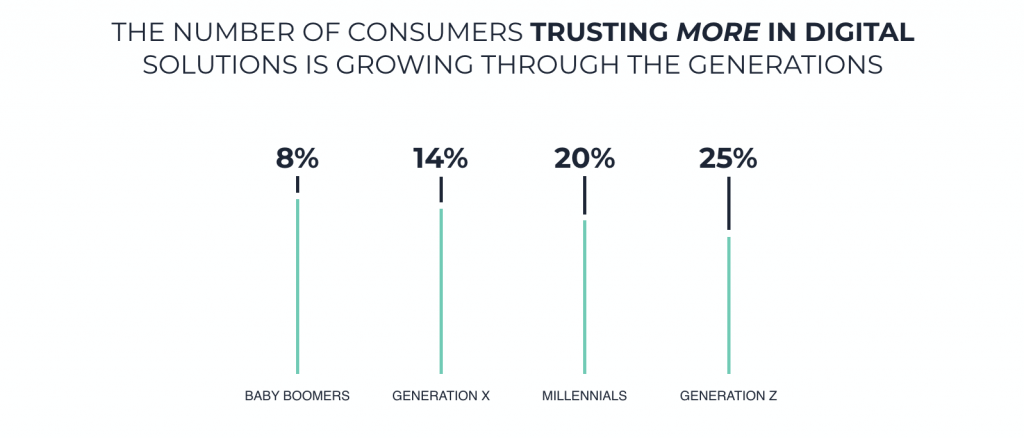

Bonus insight: Young people trust more and more in digital solutions

11. The number of consumers trusting more in digital solutions is growing through the generations.

Right now traditional banks can boast a greater level of consumer trust over younger Fintechs because of the time they have been around. However, this won’t be the case for long as trust continues to grow amongst younger generations.

In short, traditional banks need to shake up how they work to keep up with the greater pace of change amongst younger generations.

DIVE DEEPER —

Download the full report —

‘Next Generation Of Banking: From Legacy To Leader’

This article is based on insights from our deep dive report on Next Generation Of Banking: From Legacy To Leader.

This report explores how banks need to challenge their most fundamental assumptions to stay relevant to new generations of consumers and competitors.

It introduces the different approaches to transformation and consequences of avoiding large-scale change. Moreover, banks can explore our recommendations for first steps towards organization-wide transformation.